Accounting managers have a degree of freedom in choosing how to account for certain items and transactions. This section discusses the most significant areas of…

Income Sales, also known as revenues, represents all income from sales of the company’s products and/or services. Gross sales: Gross sales is the sum of all sales…

Owners’ equity represents the excess of total assets less liabilities. It consists of four components: capital stock, additional paid-in capital, retained earnings, and minority interest. Capital…

Like assets, liabilities can be either current or long-term. Current Liabilities Current liabilities are those that are due or expected to be paid within the next 12 months.…

Assets include both current assets and long-term assets. Current Assets Current assets are those assets expected to be realized (converted to cash) within the next 12 months.…

Financial accounting is categorized into four basic elements: assets, liabilities and owners’ equity, revenues, and expenses (each of which is explained below). Assets and expenses are represented by net debits,…

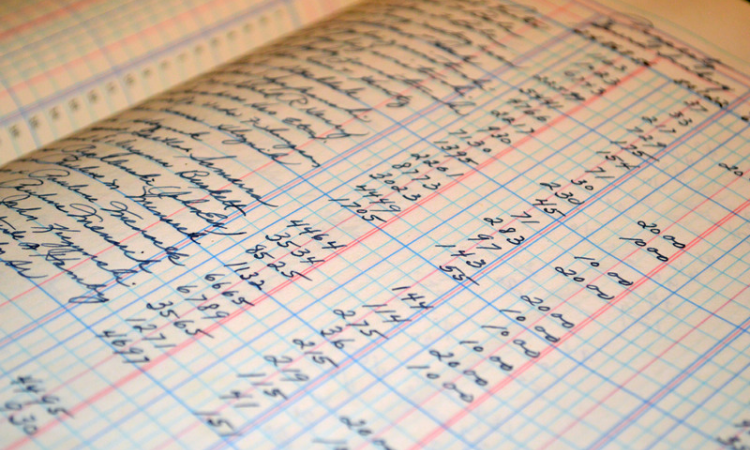

Accounting is based on a number of fundamental concepts that are applied universally. All amounts recorded on the company’s balance sheet are made at recorded cost.…

The fundamentals of financial accounting are essential, whether you’re starting your own business, taking a finance class, or analyzing a company’s annual report as a…

The most important role of accounting statements is to provide a tool for managers and investors to analyze, evaluate, and interpret a company’s financial performance…

Whether your business is big or small, you will need a means of accounting so that you will not lose track of costs, expenses and…